Responsible Investing

Our independent and employee-owned firm invests actively and responsibly to generate wealth for our clients. We believe environmental, social, and governance (ESG) factors can materially impact on a company’s valuation, financial performance, and related risk/return. We think inclusion of ESG analysis enhances our research and stock selection process. In support of these beliefs, CRM became a signatory of the Principles of Responsible Investing (PRI) in November 2017 and a public supporter of the Task Force on Climate-related Financial Disclosures (TCFD) to improve and increase reporting of climate-related financial information in April 2021. Concurrent with the release of its 2023 status report on October 12, 2023, the TCFD fulfilled its remit and disbanded. The Financial Stability Board (FSB) has asked The International Financial Reporting Standards Foundation (IFRS) to take over the monitoring of the progress of companies’ climate-related disclosures. CRM continues to remain committed to the process and is monitoring the IFRS for further instruction. Please find CRM’s most recent PRI Transparency Report here.

As part of our approach to ESG integration, investment analysts evaluate, document, and integrate relevant ESG factors into their due diligence and investment theses of each potential investment. Analysts and portfolio managers review publicly available company and industry specific ESG information as well as third party ESG data (i.e. MSCI, Bloomberg, ISS) and assess potential risks or opportunities. As part of the portfolio management process, investment analysts monitor ESG issues and track significant ESG ratings changes of the portfolio holdings. Core to our active investment style, we engage in ongoing dialog with the companies in which we invest, often addressing material ESG issues. For more information, see our Responsible Investing Policy, Engagement Policy, and Proxy Voting Policy.

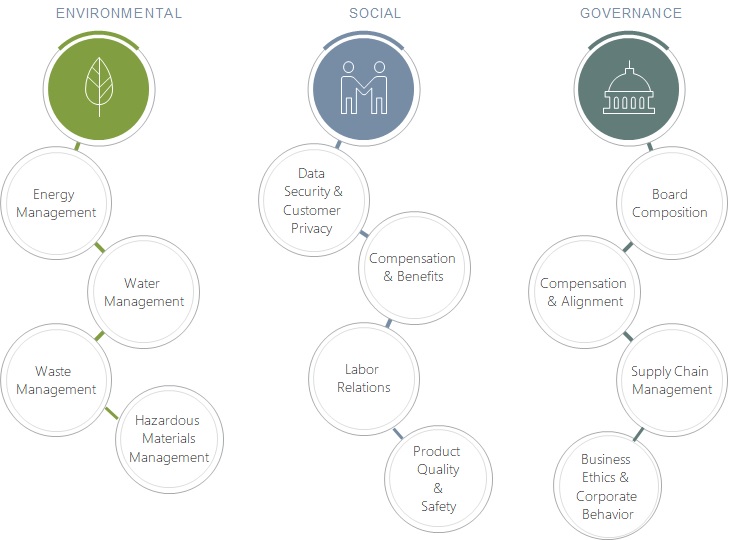

Examples of relevant ESG considerations: