Building Investment Conviction

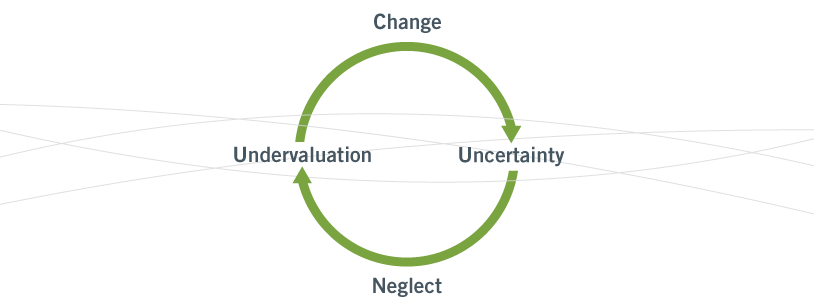

CRM generates ideas from both qualitative (approximately 75%) and quantitative (approximately 25%) sources. Qualitative ideas emanate from company presentations, news services, due diligence on existing holdings, our internal research database, leveraging investment themes, and rich text screening for specific change expressions such as “acquisition,” “restructuring,” etc. The quantitative sources include screening for stocks that have underperformed the market or peer companies over certain time periods, screening for companies fundamentally underperforming and demonstrating operating margins below their own history or peers, and ranking stocks by sell-side or buy-side sentiment. Ideas actively being researched are what we call “work in process.” Analysts and portfolio managers discuss these ideas collectively and strategize additional due diligence. Analysts build a detailed financial model and continuously provide feedback to portfolio managers. As part of this process, analysts develop an “Investment Case,” which documents the investment thesis. It consists of a brief company description, a discussion of the change(s), and assessment of the relative neglect and valuation. The Investment Case also includes an assessment of the risks relevant to the thesis, relevant ESG considerations, and establishes upside and downside price targets.

Buy Discipline

Our investment process is very team oriented and collaborative. There are typically multiple analysts/portfolio managers engaged in a review and discussion of new ideas and Investment Cases. If the risk/reward ratio is deemed attractive by the portfolio managers in the context of their overall portfolio construction, a decision will be made by the portfolio managers to initiate a position in the stock. The portfolio managers will modulate the position size depending upon the relative attractiveness of the idea, the expected return, and other risk considerations.

Sell Discipline

CRM’s process is focused not only on building the Investment Case, but also on understanding how the case might deteriorate. A position will generally be sold when one or more of the following occurs: an established price target is approaching or is attained, implying the stock has reached our estimation of fair valuation; a factor in our initial investment thesis has deteriorated causing us to reassess the potential for the company; or we identify a more promising investment opportunity. After a decision to sell is made, the investment is replaced by either a new idea or existing holdings that offer a greater risk/reward profile.