Capitalizing on Change and Neglect

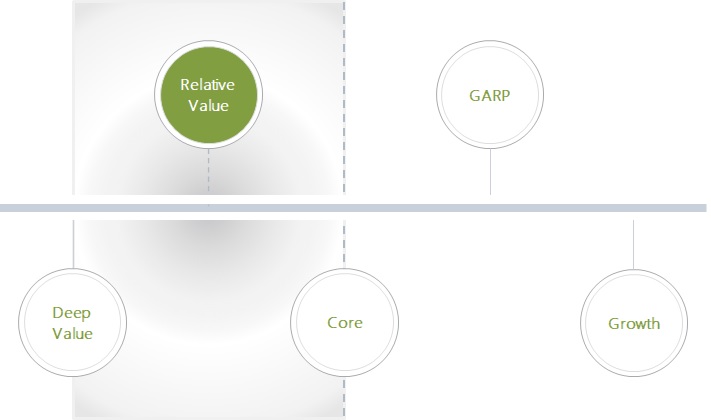

On the investment style spectrum, CRM’s focus lies left of ‘core’ and right of ‘deep value.’ A fair label would be relative value, which allows for thoughtful and opportunistic investing within the framework of our valuation discipline.

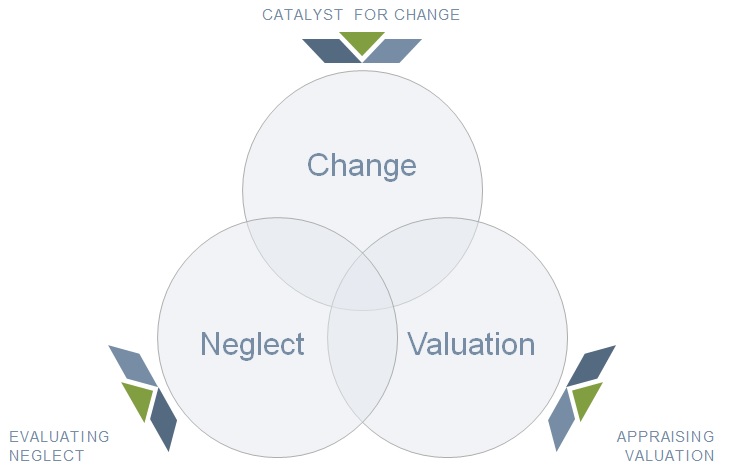

CRM views investment prospects on a long-term basis. Our relative value-oriented investment philosophy is designed to outperform the broad market and pertinent indices over a full market cycle by participating in good market periods and limiting declines in poor periods. CRM believes successful investing is a result of recognizing and responding to changes that may positively impact the future prospects of a business enterprise. Often times, investors misunderstand the potential benefits of these changes, resulting in relative neglect, which reduces the risks of investing at a point in time. We believe this results in investing in companies that are under earning both their potential and consensus expectations. As relative value investors, we seek to invest in companies that are trading at a discount to their own history and peers based upon prospective free cash flow and earnings. In summary, our investment approach is predicated on change, neglect, and valuation.

Change

CRM seeks to identify change at an early stage that may be material to the future operations of publicly traded companies. The financial markets present a multitude of change opportunities. On a regular basis, investors are presented with management changes, spin-offs, cost restructurings, capital returns to shareholders, acquisitions, joint ventures, divestitures, regulatory changes, new products, and activist investors.

Neglect

In its earliest stages, change tends to be greeted with skepticism. The uncertainty resulting from the change creates a period of relative neglect or lowered expectations as investors wait for more clarity. CRM seeks to evaluate neglect by studying sell-side analyst coverage and recommendations, institutional ownership, key concepts in behavioral finance such as over and under reactions to news flow, and having a differentiated view about the future outlook for the business.

Valuation

When change meets neglect, the intrinsic value of a company may exceed the current stock price. CRM appraises the business using a number of methodologies, but most are dependent upon our modeling of future free cash flows. CRM looks to normalize the cash flow and earnings streams for one time or unusual items, which themselves often create neglect. In many cases, reported GAAP earnings understate or distort a company’s underlying free cash flow. As relative value investors, we are looking to invest in companies which are trading at a discount to their own history, peers, and when appropriate, our assessment of its value to a strategic or private equity buyer.